Becker is in a unique position to advise on Opportunity Zone investment, and the related issues that may arise in conjunction with participation in the program.

Becker offers an A to Z suite of practice areas necessary to help you understand and implement your strategies for participation in the Qualified Opportunity Zone program whether you are a public entity, developer, or investor. We understand that operating in this space requires a cross-practice, multifaceted approach to navigating the policy, logistical, legal, and regulatory hurdles that may arise. Our multi-disciplined team of government policy, real estate, construction, public-private partnership (P3), corporate, and estate planning professionals collaborate to advise and provide full-service guidance to educate clients about the program, evaluate whether the program is consistent with client goals, address legal and regulatory hurdles, and help execute engagement in the program.

ABOUT OPPORTUNITY ZONES

The program provides a tax incentive for investors to re-invest their unrealized capital gains into so-called “Opportunity Funds” that are dedicated to investing into state-designated Opportunity Zones. The sites are chosen by the state and then approved by the Federal government.

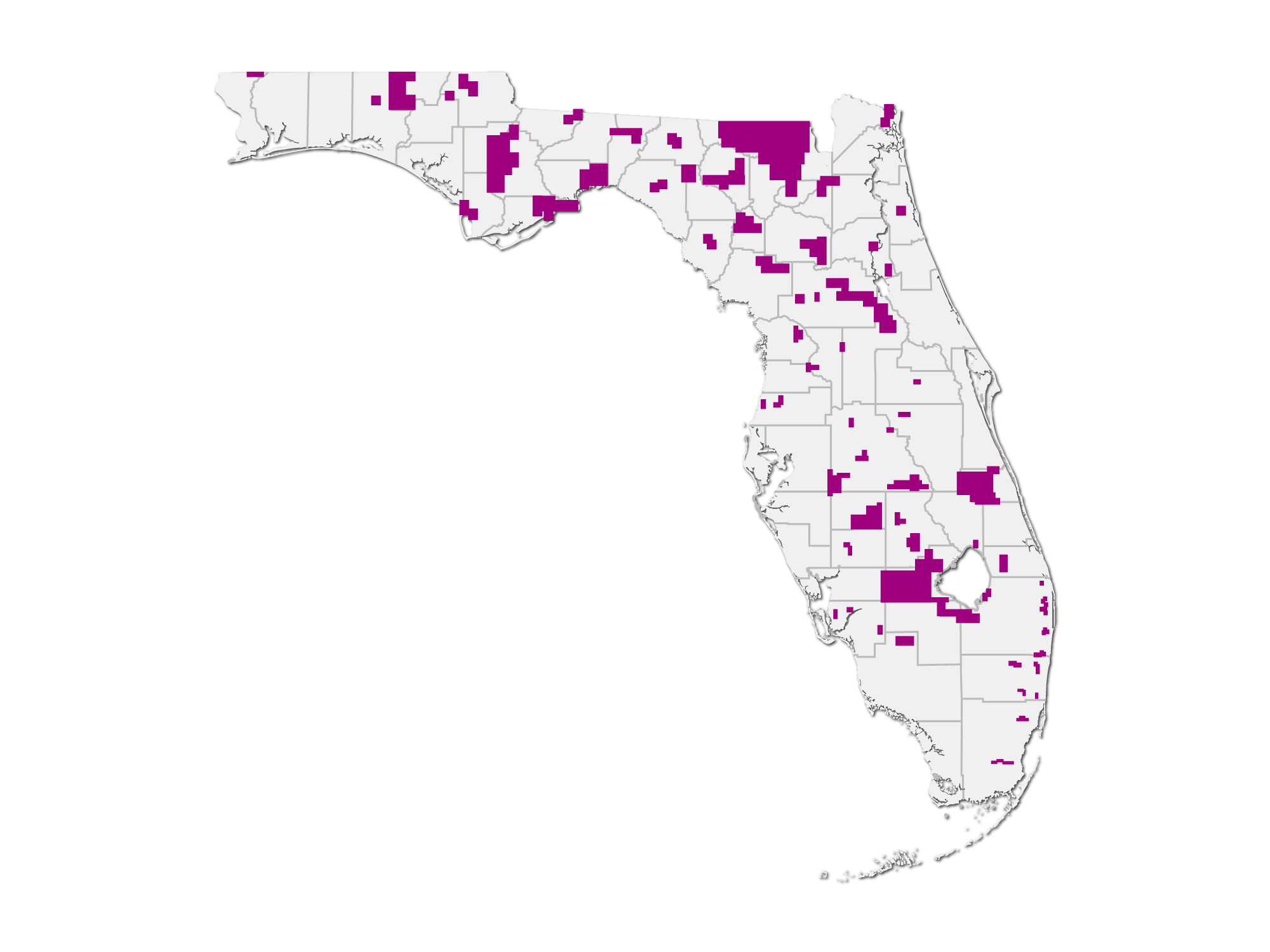

8,761 communities in all 50 states, D.C. and five U.S. territories have been designated as Opportunity Zones, including 427 Opportunity Zone sites in Florida alone. These communities present both the need for investment and significant investment opportunities:

- Average poverty rates of 32 percent compared with a U.S. average rate of 17 percent.

- Unemployment rates 1.6 times higher than the average U.S. census tract.

- Median family income on average 37 percent below the state median.

Under the program, individuals and other entities can delay paying federal income tax on capital gains until as late as December 31, 2026 if those gains are invested in “Opportunity Funds” that invest at least 90% of their assets in businesses or tangible property located in low-income areas designated as Opportunity Zones. The tax benefits could reduce the cost of capital for these projects, making them more viable, especially when paired with other development incentives like the New Markets Tax Credit. Congress intended that the OZ program operate with minimal restrictions in order to maximize investor participation and thus economic activity and job creation.

Investors benefit when they invest the amount of prior capital gains in these designated Opportunity Zones.

ECONOMIC BENEFITS

Developing Communities

Opportunity Zones represent more than a simple tax break – they are a powerful vehicle for bringing economic growth to communities that need it most, but have not had the investment historically to independently create jobs, build environments to incentivize business relocation, or increase the quality of life for their residents. Opportunity Zones can help create momentum in communities that need a boost in their economic recovery efforts, representing a vital new funding opportunity for cities and counties throughout the country.

The Becker QOZ Team provides a full spectrum of cross-practice services to help fund sponsors, cities/counties, developers, innovators, and investors understand and implement this new program in order to unlock its full investment potential.

Who Should Participate in the OZ Program?

This program will have numerous stakeholders representing an equal number of perspectives, including:

- Cities, Counties and Community Redevelopment Associations

- Fund sponsors

- Real estate developers

- Public/Private Colleges and Universities

- Innovators and Tech Startups

- Family Offices, Institutional and Private Investors

A Summary of the Newly Announced Second Set of Regulations

At White House Conference on Opportunity Zones, President Trump and Secretary Mnuchin Announce Second Round of Regulations

The Department of the Treasury released its second set of proposed rules for the tax-incentive program designed to encourage economic development in distressed areas throughout the U.S. known as the Qualified Opportunity Zone Program.

Becker Senior Government Relations Consultant Clarence Williams attended an invitation-only White House conference on Opportunity Zones where Secretary Steve Mnuchin outlined some of the more high-profile proposed regulations before and after speeches given by HUD Secretary Ben Carson, Council on Economic Advisors Chairman Kevin Hassett, and President Trump himself.

The 169-page proposal gives investors interested in these areas additional leeway and a more flexible timeline, according to Secretary Mnuchin. The rules also give investing funds a one-year grace period to sell assets and reinvest the proceeds, thus avoiding penalties intended to prevent funds from sitting on the cash.

A Summary of the Newly Announced Second Set of Regulations

Senior Government Relations Consultant Clarence Williams gave a firm-wide presentation on the Qualified Opportunity Zone Program. He explored various topics of interest including the formation of Qualified Opportunity Zones (QOZ), laws pertaining to QOZs, and the various uses associated with them.

LIVE NEWS FEEDS

National

Florida

ADDITIONAL RESOURCES

BECKER’S UNIQUE CAPABILITIES

Government Law and Lobbying

Our Government Law and Lobbying practice educates entities on the development of investable projects; advises on regulatory considerations related to organizing and operating Opportunity Funds; advises public clients on complimentary funding mechanisms; hosts presentations and speaking engagements on the QOZ program as the program continues implementation; and, continues to follow regulatory and statutory progress providing advocacy as needed.

Real Estate

Real Estate Law has been a core practice for Becker since its founding in 1973. Our clients include national developers, business and property owners, and financial institutions. The firm’s Real Estate attorneys have helped shape the local landscape through representation of developers of multi-family and single-family residential communities; business and property owners; and financial institutions. They have represented clients in the successful acquisition, financing, development and sale of all types of unimproved land and improved properties for residential and commercial use, including large land assemblages, major office buildings and office parks, shopping malls and centers, luxury hotels and resorts, condominiums and multi-family housing projects.

Construction Law and Litigation

With one of the largest, dedicated teams of Board Certified Construction attorneys, Becker’s Construction Law Practice Group is well-known nationally for its knowledge of the construction industry and experience effectively protecting the interests of its clients. Our construction attorneys represent clients in both transactions and disputes ranging from single- and multi-family dwellings to large commercial buildings, planned unit developments, multi-use retail, industrial and governmental projects.

Public, Private Partnership (P3)

As QOZs are designated based on community statistics, many zones are densely residential areas, where large-scale development may prove difficult. While 90% of Opportunity Zone funds must be invested inside the QOZ, remaining investment for joint projects may extend outside of those boundaries, where additional investment may be needed to complete multi-phase projects. Becker’s Public, Private Partnership (P3) team has proven public and private sector knowledge, experience and contacts to assist governmental entities and private businesses and entities seeking to partner on public facilities projects.

Corporate Law

Becker’s Corporate Practice Group takes pride in quarterbacking our clients’ transactions and focuses on closing. We consider your success, our success. Among other areas, our New York, Florida, and New Jersey-based team handles Asset Protection, Wealth & Business Preservation; Broker-Dealers & Investment Advising; Private Funds; Intellectual Property; Capital Markets; Private Equity; Corporate Tax Transactions and Planning; and, Tax Controversies.

IN THE NEWS

ZONE MAP

For a list of Florida’s Qualified

Opportunity Zones, Click Here

for a searchable map of all Qualified Opportunity Zones, Click Here

CONTACT US

Opportunity Zones are an important stepping stone to wealth creation in low-income communities and opportunity for businesses and investors to bring jobs and development into these neighborhoods. Your Becker & Poliakoff team is immediately ready to partner with you in this fast-moving opportunity.

Construction Law & Litigation

Public, Private Partnerships (P3)

Fort Lauderdale, FL